Haftungsausschluss des Autors: Dieser Leitfaden stellt keine Rechtsberatung dar. Wenn du Fragen zu deinen Steuern hast, solltest du dich an einen Buchhalter oder Steueranwalt wenden.

Geschrieben von Dr. Daniel Gold, PhD

Herausgegeben von Julia Martin

Einleitung des Herausgebers

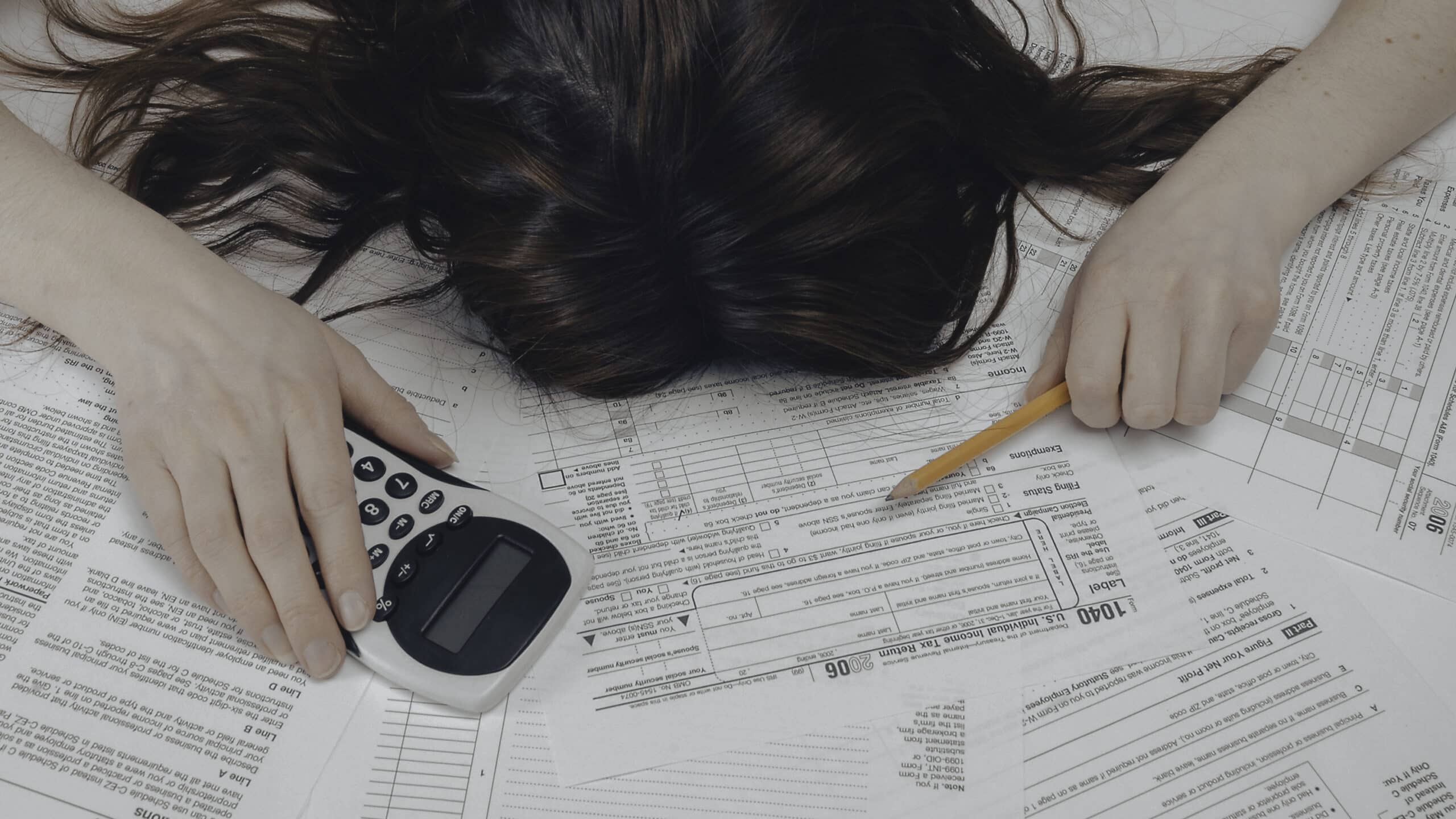

Steuern können für unseren kreativen Geist sowohl rätselhaft als auch angstauslösend sein. Es gibt viele Regeln, und die Formulare - sowohl auf Papier als auch in der Software - sind Labyrinthe, die den menschlichen Geist zu erdrücken scheinen. Unser Ziel ist es, Experten zu Wort kommen zu lassen, um die besten Ressourcen und Anleitungen für Künstler/innen bereitzustellen. Diese praktischen Tipps stammen von einem ehemaligen Steueranwalt, einem Freiberufler in der Tech-Branche und einem Autor von Belletristik, der aus dem einzigartigen Blickwinkel eines gut informierten Kreativen auf die Dinge schaut.

Aus Erfahrung wissen wir, dass der beste Weg, die Steuerzeit zu überstehen, darin besteht, mit so viel Verständnis und Vorbereitung wie möglich durch die Steuerzeit zu gehen, denn das ist ein Bereich, in dem uns unser Charme und unsere Talente nicht weiterbringen. Das ist die mahnende Geschichte des Autors:

Erstens: Was man nicht tun sollte

Ein erfolgreicher, pensionierter Künstler hatte um Hilfe bei seinen Steuern gebeten - er hatte noch offene Steuerschulden. Angesichts der hohen ausstehenden Schulden bei der Regierung schlug der Künstler vor, mit unverkauften Kunstwerken zu bezahlen. Obwohl es sehr schöne Stücke waren, kam das nicht gut an. So war es keine Überraschung, dass sie ihre Steuern mit Geld und nicht mit Kunstwerken bezahlen mussten.

Damit du nicht in eine solche Situation gerätst, enthält der folgende Leitfaden einige Best Practices für Künstler, Designer und Freiberufler, die sich auf die Steuersaison vorbereiten.

1. Zahle deine Steuern pünktlich und lege Geld für sie zurück. Wenn du Zweifel hast, zahle zu viel.

Meiner Erfahrung nach ist das die Nummer eins, die Freiberufler in Schwierigkeiten bringt. Sie unterschätzen ihre Steuerzahlungen, die Zinsen und Strafen türmen sich auf und sie geraten in echte Schwierigkeiten.

Auch wenn du dir über die Höhe deiner Steuern nicht sicher bist oder glaubst, dass du falsch veranlagt wurdest und die Steuern anfechten willst, ist es am besten, wenn du deine Steuern zuerst bezahlst.

Es ist leicht, mit der Steuererklärung in Verzug zu geraten, besonders wenn du als Unternehmer oder Selbstständiger arbeitest, denn viele Designer, Fotografen und Künstler aber du kannst deine Steuern auch dann zahlen, wenn du den genauen Betrag noch nicht ermittelt hast, den du schuldest. Nimm einfach eine grobe Schätzung vor, die sich grob an dem Betrag orientiert, den du in diesem Jahr oder im Vorjahr verdient hast, und versuche, zu viel zu zahlen. Auf diese Weise kannst du Strafen und Zinsen vermeiden.

Wenn du alles im Griff hast, kannst du deine Steuern nachreichen und dir den zu viel gezahlten Betrag vom Staat zurückholen. Es ist also am besten, wenn du mit der Steuererklärung nicht in Verzug gerätst, aber wenn du es doch tust, solltest du trotzdem das bezahlen, was du vermutest, dass du es schuldest.

Ein Hinweis zum Bezahlen deiner Einkommenssteuer: Einige Regierungen bieten verschiedene Direktzahlungskonten an, eines für die aktuell geschuldeten Steuern und eines für zukünftige Steuern. Diese beiden Konten können leicht verwechselt werden. Achte genau darauf, auf welches Konto du deine Zahlungen leistest, denn das später zu korrigieren, ist sehr mühsam.

2. Wisse, dass deine Steuern stark ansteigen können, auch wenn dein Einkommen nur ein wenig steigt

Die Steuerfalle für Künstler ist die Unvorhersehbarkeit und Schwankung deines Einkommens. Je nach Region fallen in der Regel so gut wie keine Einkommenssteuern an, wenn du anfängst und so gut wie nichts verdienst. In einem guten Jahr kann deine Steuerlast jedoch stark ansteigen. Da die Steuerklassen am unteren Ende der Skala unterschiedlich sind, können $20.000 im Jahr 5% Steuern bedeuten ($1.000 Steuern), während $75.000 im Jahr 25% Steuern bedeuten können ($18.750).

Anmerkung der Redaktion: Mehr Geld, mehr Probleme lässt sich für Steuerpflichtige besser als ein bisschen mehr Geld, viel mehr Probleme umschreiben.

Auch wenn es ein Dämpfer für die Feier eines neuen Vertrags oder einer großen Übernahme sein kann, ist die beste Zeit für die Steuerplanung, wenn die Dinge gut laufen. Wenn du in guten Jahren für Steuern und unerwartete Ausgaben sparst, kannst du Überraschungen und unnötige Turbulenzen vermeiden. Es kann hilfreich sein, ein separates Bankkonto zu haben, auf dem du Geld zurücklegst. Es gibt vielleicht Möglichkeiten, dein Einkommen zwischen guten und schlechten Jahren zu verschieben, um deine Steuerlast auszugleichen, vor allem wenn du ein eingetragenes Unternehmen betreibst, aber darüber musst du mit einem Steuerberater sprechen.

3. Wissen, wann du ein unabhängiger Auftragnehmer oder ein Angestellter bist

Künstler und Designer arbeiten oft als selbstständige Unternehmer, was erhebliche steuerliche Auswirkungen hat. Selbstständige Unternehmerinnen und Unternehmer führen ihr eigenes Unternehmen und können Betriebsausgaben absetzen (so dass sie keine Steuern für diese Ausgaben zahlen müssen). Sie gelten jedoch nicht als Arbeitnehmerinnen und Arbeitnehmer und genießen nicht den Schutz und die Vorteile, die Arbeitnehmerinnen und Arbeitnehmer erhalten.

Dieser Schutz und diese Vorteile (einschließlich Krankenversicherung, Abfindungszahlungen, Überstunden, Krankheitstage, Elternurlaub und andere Schutzmaßnahmen am Arbeitsplatz) sind in der Regel mehr wert als die Steuerabzüge, die du für deine Ausgaben als selbstständiger Unternehmer erhältst. Wenn du also fast ausschließlich bei einem Unternehmen angestellt bist, bist du wahrscheinlich ein Angestellter und solltest das prüfen, da es langfristig für dich vorteilhafter ist.

Außerdem werden die Arbeitnehmersteuern in der Regel einbehalten und direkt an den Staat abgeführt. Das macht die Steuererklärung billiger und einfacher und verringert das Risiko, dass du mit Zinsen und Strafen belastet wirst.

4. Organisiere deine Quittungen und Rechnungen

Internet-Rindfleisch und Betriebsprüfungen haben eines gemeinsam: Sie verlangen Belege. Du kannst deine Bücher selbst führen oder einen Buchhalter einstellen. Du kannst deine Steuern selbst einreichen oder einen Buchhalter beauftragen. In jedem Fall musst du deine Geschäftsausgaben und -einnahmen mit Belegen und Rechnungen belegen. Überlege dir ein System zum Sortieren und Nachverfolgen, das für dich geeignet ist: Das kann ein Ordner mit Registerkarten sein, wenn du ein besonders taktiler Künstler bist, oder es gibt tolle Online-Tools und Software.

Wenn du es digital und einfach halten willst, kannst du einfach eine Tabellenkalkulation verwenden (Google Sheets ist kostenlos). Du kannst auch physische Kopien von allem aufbewahren oder sie einscannen, indem du die Kamera deines Handys als Scanner benutzt. Wie auch immer du vorgehst, wenn du dir angewöhnst, deine Ausgaben (und Einnahmen) zu erfassen und zu organisieren, wird dein Leben viel einfacher. Plane, deine Quittungen und Steuerunterlagen 7 Jahre lang aufzubewahren. Es kann mühsam sein, alte Bank- und Kreditkartenbelege zu besorgen. Deshalb empfehle ich dir, bei der Steuererklärung alle Belege der letzten Jahre herunterzuladen und sie aufzubewahren, falls du sie später als Nachweis brauchst.

5. Recherchiere, was du abschreiben kannst

Je nach Art deiner Arbeit und deinem Medium gibt es unterschiedliche Gegenstände, die du abschreiben kannst. Die wichtigste Regel lautet: Wenn du es für die Arbeit gekauft hast, kannst du es abschreiben. Bedenke aber, dass eine Abschreibung nur bedeutet, dass du für die Ausgaben für diesen Gegenstand keine Steuern schuldest. Du hast immer noch weniger Geld, als wenn du den Gegenstand gar nicht gekauft hättest. Es ist also immer noch besser, etwas nicht zu kaufen, das du nicht brauchst, als es abzuschreiben.

Anmerkung der Redaktion: Es ist kein Gratisgeld.

Ein paar Vorbehalte: Mahlzeiten können oft abgesetzt werden, aber in der Regel nur zu einem reduzierten Betrag und in der Regel nur, wenn sie Teil eines Geschäftstreffens oder einer Reise außerhalb deiner Wohnung oder deines normalen Arbeitsplatzes sind.

Für Autokosten und Kraftstoff gibt es sehr genaue Regeln, um zu verhindern, dass jeder sie absetzen kann. Überprüfe die Regeln genau, wenn du selbstständig arbeitest und mit dem Auto zu Auftritten fährst.

Generell kann Kleidung nur dann abgeschrieben werden, wenn es sich um ein Kostüm oder eine Schutzausrüstung handelt und nicht um etwas, das du auch sonst tragen würdest, z. B. eine Warnweste, reflektierende Kleidung für Nachtdrehs oder eine Atemschutzmaske für Maler.

Jetzt kostenlos loslegen

Wir haben uns auf Portfolio-Websites spezialisiert, damit du dich auf dein Handwerk spezialisieren kannst. Format ist seit 2012 für die Kreativbranche tätig. Werde Teil unserer Gemeinschaft von Branchenführern.

Größere Anschaffungen wie teure Kameras und Computerausrüstung müssen als Investitionsausgaben abgeschrieben werden, die nach einer von der Regierung veröffentlichten Tabelle, die je nach Ausrüstung variiert, über mehrere Jahre abgezogen werden. Im Allgemeinen werden Investitionsgüter mehrere Jahre lang genutzt und haben einen gewissen Wiederverkaufswert (z. B. alte Objektive oder Fotolampen). Wenn du zu den Künstlern gehörst, die viel Ausrüstung benötigen, lohnt es sich, mit einem Steuerberater zu besprechen, wie die Ausrüstung einzuordnen ist.

Die Verfolgung von Kapitalausgaben kann mühsam sein und ist ein guter Grund, den Einsatz einer Buchhaltungssoftware in Betracht zu ziehen.

6. Steuervermeidungsprogramme sind Betrug

Es gibt Dutzende von Betrugskursen und Betrügern, die dir eine Möglichkeit versprechen, Steuern zu vermeiden. Manchmal handelt es sich dabei um spezielle Anlageformen, merkwürdige Immobiliengeschäfte, Offshore-Konten, Behauptungen, dass du Urlaube ausgeben oder eine Art Zauberformel verwenden kannst, um Steuern zu vermeiden.

Das sind alles Betrügereien. Viele von ihnen bereiten dich auf eine riesige Steuerrechnung vor, die dich fünf Jahre später überrascht, wenn gegen dich ermittelt wird und du das Dreifache des gesparten Geldes an Steuernachzahlungen, Strafen und Zinsen schuldest. Oft wird dir bei diesen Betrügereien auch direkt das Geld gestohlen, denn wenn die Investition außerhalb des normalen Gesetzes liegt, hast du auch keinen Rechtsanspruch darauf, das Geld zurückzufordern, wenn sie damit abhauen.

Als Steueranwalt hatten wir eine Reihe von Mandanten, die auf diese Machenschaften hereingefallen waren. Als die Regierung die Steuernachzahlungen einforderte, war das Geld bereits ausgegeben, und sie steckten in großen, oft lebensbedrohlichen Schwierigkeiten. Wenn eine seriöse Investition (die von einem etablierten Unternehmen mit einer Niederlassung und langjähriger Erfahrung angeboten wird) behauptet, dass sie eine Art Steuervorteil bietet, solltest du dich zuerst bei deinem Steuerberater und Anwalt erkundigen. Wenn du kein reguläres Konto und keinen Anwalt hast, solltest du diese Art von Investition nicht tätigen.

Niemand zahlt gerne Steuern, aber es ist unrealistisch, sie zu vermeiden, und schließlich wissen wir als Kreative, dass die Steuern einige der Programme finanzieren, die uns unterstützen.

7. Wähle die richtige Software

Die meisten Buchhaltungs- und Buchführungsprogramme sind gut genug. Das Wichtigste ist, dass du eine Software auswählst, die du auch wirklich benutzen wirst. Suche nach Software, die du intuitiv findest. Die meisten Unternehmen sind dazu übergegangen, Software im Abonnement anzubieten, und das nicht, weil es für den Verbraucher billiger ist.

Außerdem solltest du überlegen, welche Software dein Buchhalter und dein Steuerberater verwenden, in welche Ökosysteme du dich einkaufen möchtest, ob du Waren online verkaufst und ob das zu einem bestimmten Softwarepaket passt, ob du einen Abonnement-Service oder einen einmaligen Kauf bevorzugst und ob deine Verkaufsplattform Steuern für dich einzieht und abführt.

8. Wissen, wann man eingliedern muss

Wenn du selbstständig arbeitest, hat eine Unternehmensgründung eine Reihe von Vorteilen. Sie ermöglicht es dir, bestimmte Steuerkosten zu vermeiden, und schützt dich vor bestimmten Verbindlichkeiten. Oft kannst du das Geld in der Kapitalgesellschaft weitgehend unversteuert lassen und es nur abheben, wenn du es brauchst. Das kann für die Ruhestands- und Nachlassplanung und für die Aufteilung des Einkommens mit einem Partner oder Angehörigen sehr vorteilhaft sein, wenn dies erlaubt ist. Die Gründung einer Kapitalgesellschaft erhöht jedoch die Komplexität der Bankgeschäfte und es gibt bestimmte unvermeidbare Gebühren, die eine Kapitalgesellschaft mit sich bringt.

Generell gilt: Wenn du dauerhaft mehr als $75.000+ im Jahr verdienst, lohnt es sich, über eine Unternehmensgründung nachzudenken. Du solltest mit einem Anwalt oder Buchhalter darüber sprechen, da die Situation bei jedem anders ist.

Zum Schluss...

Zusammengefasst: Bewahre deine Belege auf, wisse zuerst, was eine Abschreibung ist, und dann, was du abschreiben kannst. Es ist besser, zu viel zu zahlen und eine überraschende Rückzahlung zu erhalten, als zu wenig zu zahlen und einen Schock zu erleben. Es lohnt sich, in eine gute Software zu investieren, oder noch besser, in einen vertrauenswürdigen Experten.

Viel Glück! Mögen deine Unternehmungen fruchtbar sein, deine Arbeit sinnvoll, dein Einkommen hoch und deine Steuern niedrig.